Are Income Share Agreements (ISAs) Scams?

Last Updated: June 5th 2024

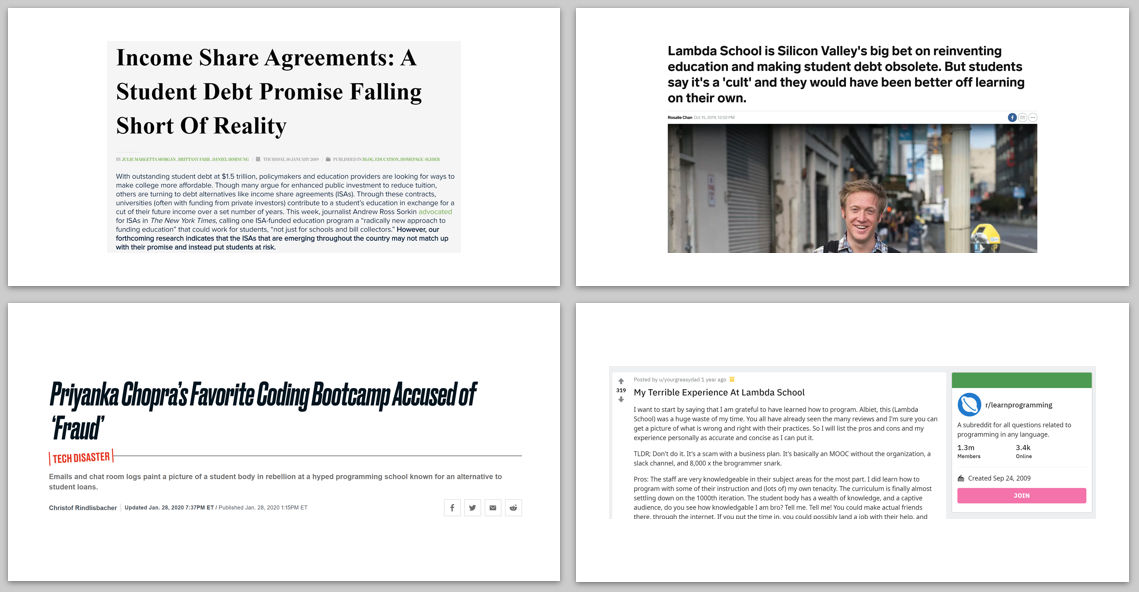

With looming regulations, and increased litigation, predatory ISA programs are being exposed.

(This is the first article in our series on ISA programs. Read the second article The Hidden Truth About ISAs, and the third about Nucamp's Fair Student Agreement)

With education costs continuing to rise, many students rely on loans to pay for college or other education programs.

For students who get multiple degrees, debt can reach six figures before they’ve even started a full-time career.

This is especially tough on students who have delays in finding their dream job or take a position at a lower salary than they expected.

In response to the traditional student loan structure, some colleges, educational institutions, and even coding bootcamps have adopted Income Share Agreements (ISAs) as an alternative tuition payment option.

But buyer beware.

Read the fine print on an ISA before signing.

What is an ISA?

ISA programs allow students to delay paying tuition until they secure a job at a specified annual salary.

When the graduate is hired into a job, they pay the school a percentage of their gross salary over a set number of years, or until a payment cap is reached.

For example, once a student lands a job with an annual salary of at least $40,000, they pay the school 15% of their gross salary, which in this case is $6,000 a year - $500 a month.

These payments continue until the total reimbursement reaches a payment cap.

This differs from a traditional student loan, which expects payments to start 6 months after graduation regardless of the student’s employment status.

But that’s not the only difference.

Do ISAs sound too good to be true?

The short answer is yes - depending on the ISA program details.

Tony Wan from Ed Surge wrote, "Critics say ISAs are yet another instrument of student debt, prone to deceptive marketing and predatory lending terms.”

Matt Taylor from Vice.com wrote, 'Income Sharing' Is Wall Street's Potentially Predatory Alternative to Student Loans. The Hot New Millennial Trend is something critics call "indentured servitude."

Malcolm Harris from the New York Times wrote, "What’s Scarier Than Student Loans? Welcome to the World of Subprime Children."

These criticisms may be harsh, but they’re not wrong.

What you should know about ISAs.

Disguised Interest of ISAs:

Many ISAs claim to be interest-free.

But in many cases, as Robert Farrington wrote from Forbes, this is not the case.

Students end up paying so much more than the original tuition.

This is because ISAs charge a percentage of a student’s future salary over a period of years.

That percentage does not change if you get a raise.

So, if your salary increases, so does your payment.

ISAs overcharge borrowers:

Some bootcamps are setting the repayment caps at $30,000-$40,000 for an online learning experience that lasted less than 6 months.

So, for students who pay in full up front, they pay the base tuition of, let’s say, $17,000.

But the students who signed up for the ISAs pay almost double that for the same course.

$17,000 is expensive, never mind $30,000.

This expense really stands out when comparing these online-only bootcamps to programs like Nucamp, which offers online learning at a fraction of the cost.

Being approved for an ISA loan could mean you actually don’t need one:

Coding Bootcamps and ISA loan providers take a financial risk when they accept a student into their program.

So, to reduce that risk, they increase the difficulty of their admission tests to only select students who offer the best chance of repaying the ISA loan.

If you have passed those tests and are accepted for an ISA loan, it’s likely that you could also get a much better deal with a more traditional (and cheaper) loan instead.

ISAs have been unregulated for too long – although this is finally changing:

ISA providers have lost many lawsuits over the years due to their misleading sales tactics.

Putting consumer protections in place has been long overdue.

State and federal government are finally responding.

In September 2021, the Consumer Financial Protection Bureau (CFPB) stated, “…regardless of the name on the label, these products are credit and have to comply with federal consumer protections. The ISA industry cannot pretend that core consumer protection laws do not apply to their products.”

In January 2022, the CFPB concluded “ISAs are private education loans under the Truth in Lending Act (TILA).”

In July 2022, the ISA Student Protection Act of 2022 , a bipartisan bill, would create a separate regulatory system tailored to ISAs.

In response to increased regulation and looming regulation, many schools have paused or stopped their ISA programs, including Purdue University's Back-a-Boiler ISA program.

How to avoid falling victim to predatory ISAs

Do in depth research on the coding education options available.

Look for coding bootcamps with lower tuition options, such as hybrid community coding bootcamps.

These programs, such as Nucamp, are typically more affordable than a full-time, in-person bootcamp.

Nucamp’s online coding bootcamps range in price from $458 for our 4-week web fundamentals bootcamp, to $2,604 for our 22-week full-stack development bootcamp.

By exploring bootcamps with lower tuition, you may reduce your need to borrow money to cover the cost.

Make sure you fully understand every aspect of the ISA.

Read the fine print to fully understand how money will be withdrawn from your salary over those years.

As we explained above, the percentage-based withdrawal of ISAs can make some students pay double the amount of the original tuition cost.

For a coding bootcamp that costs $17,000, this could result in paying over $30,000 through the ISA.

Understand what the ISA income and employment requirements are.

Some ISAs will let students wait to begin paying back money until they have a job with a salary above a certain income level.

But others only have a short “grace period” before students are required to begin paying.

Others also might require you to accept the first job offer that you receive, which may not be your top choice.

Compare the cost of the ISA versus a traditional student loan.

Will the possible overpayment on an ISA be more expensive than interest paid on a traditional loan?

By researching salary ranges for your career path and geographic location, you can estimate how much you might be making when you finish your program.

This can help you calculate which option might be more cost effective for you.

In Summary:

Before committing to an ISA, read the fine print and understand the following:

- the percentage of your gross salary that you’ll be paying per paycheck

- over how many years you’ll be paying it

- the repayment cap amount

- if you quit the bootcamp, or are expelled, what do you still owe on the ISA

Read the next article in the series: The hidden truths about ISAs. Written by Nucamp's CEO

Learn how Nucamp’ Fair Student Agreement helps you finance your tuition.

Ready to see if learning to code is for you?

Schedule a call with a Nucamp advisor today.

Find the next coding bootcamp starting near you. Click here to get started.

Ludo Fourrage

Founder and CEO

Ludovic (Ludo) Fourrage is an education industry veteran, named in 2017 as a Learning Technology Leader by Training Magazine. Before founding Nucamp, Ludo spent 18 years at Microsoft where he led innovation in the learning space. As the Senior Director of Digital Learning at this same company, Ludo led the development of the first of its kind 'YouTube for the Enterprise'. More recently, he delivered one of the most successful Corporate MOOC programs in partnership with top business schools and consulting organizations, i.e. INSEAD, Wharton, London Business School, and Accenture, to name a few. With the belief that the right education for everyone is an achievable goal, Ludo leads the nucamp team in the quest to make quality education accessible